The Future of Accounting Cybersecurity in 2024

- Shawna Echols

- Jan 31, 2024

- 2 min read

As technology continues to advance, the importance of cybersecurity in the accounting profession has become paramount. increasing threats of cyberattacks financial data, accounting professionals must adopt robust to safeguard sensitive information.

In recent years, the accounting industry has witnessed a surge in cyberattacks, targeting both large corporations and small accounting firms. Cybercriminals are becoming more sophisticated, exploiting vulnerabilities in outdated systems, and using advanced techniques to gain unauthorized access to financial data. In 2024, the cybersecurity landscape is expected to evolve, requiring accounting professionals to stay vigilant and implement proactive defense mechanisms.

Cloud-based technologies have gained significant traction in the accounting field due to their scalability, accessibility, and cost-efficiency. In 2024, accounting firms are likely to adopt cloud-based security solutions that offer robust protection for financial data. These solutions will utilize advanced encryption algorithms, multi-factor authentication, and continuous monitoring to detect and mitigate potential threats. Additionally, cloud-based security solutions will provide real-time updates and patches to ensure systems are always protected against emerging risks.

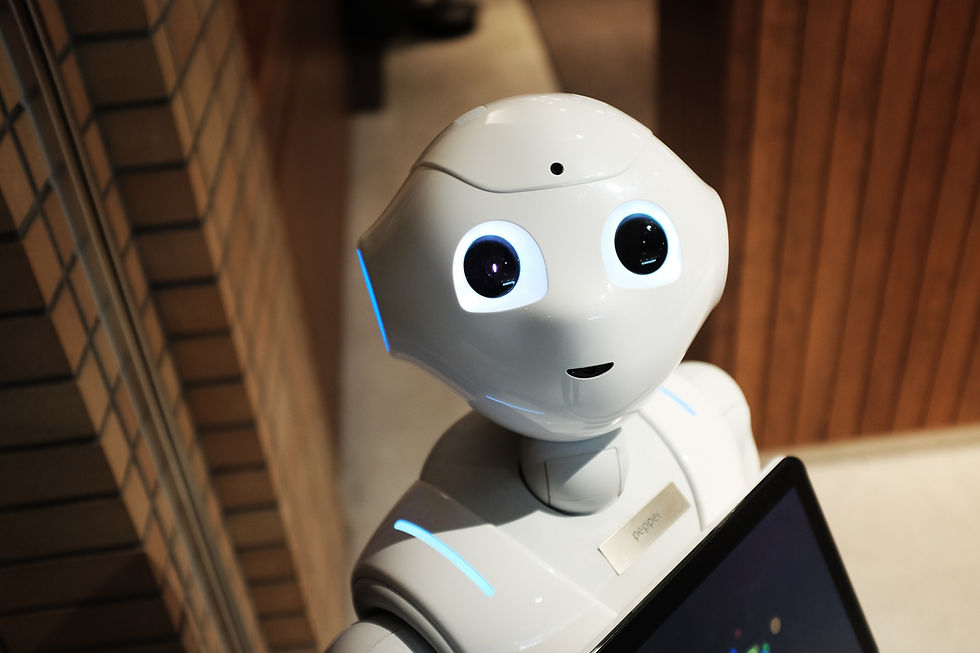

Artificial Intelligence (AI) is revolutionizing the way cybersecurity is approached. In 2024, accounting firms will harness the power of AI to enhance threat detection and response capabilities. AI algorithms will analyze vast amounts of data, identify patterns, and proactively alert accounting professionals of potential breaches or anomalies.

One of the weakest points in cybersecurity is human error. In 2024, accounting firms will prioritize employee awareness and training programs to educate staff about potential cybersecurity risks and best practices for maintaining data security. Regular training sessions simulated phishing exercises, and ongoing education will be essential in cultivating a culture of cybersecurity within the organization. Employees will be taught how to identify suspicious emails, use strong passwords, and recognize potential social engineering attempts.

Blockchain technology has gained prominence for its ability to provide secure and transparent record-keeping. In 2024, accounting professionals will explore the integration of blockchain technology to enhance data integrity. By implementing blockchain-based systems, financial transactions and records can be securely stored, accessed, and verified by all relevant parties. This ensures the accuracy and immutability of financial data, reducing the risks of tampering or fraud.

Accounting firms will need to collaborate with cybersecurity experts to stay ahead of the evolving threats. These experts will conduct regular risk assessments, perform penetration testing, and assist in the development of robust cyber defense strategies. By partnering with specialized cybersecurity firms, accounting professionals can leverage their expertise in identifying vulnerabilities, implementing effective security measures, and responding to incidents promptly.

In an ever-changing regulatory landscape, accounting professionals must stay up-to-date with relevant laws and regulations. In 2024, regulatory authorities will place increased emphasis on cybersecurity requirements and data protection. Accounting firms will need to establish comprehensive compliance programs that ensure adherence to these regulations. This includes understanding data localization requirements, data breach notification protocols, and other legal obligations to maintain stringent data privacy and protection standards.

As the digital landscape continues to evolve, accounting professionals must embrace innovative strategies to protect financial data from cyber threats. By adopting cloud-based security solutions, leveraging AI-powered threat detection, strengthening employee awareness, utilizing blockchain technology, collaborating with cybersecurity experts, and adhering to regulatory compliance, accounting firms can fortify their financial data in 2024 and beyond. Implementing these creative approaches will help mitigate risks, enhance data integrity, and safeguard the financial well-being of clients.

Comments